After weeks and weeks of mind-numbing talk from both sides, a compromise solution was finally reached on the debt ceiling crisis yesterday. Pundits are now trying to figure out who won and who lost in the skirmish. From my perspective, the status quo is maintained.

President Obama, while disappointing some of the far left, compromised enough to move towards the political center for his re-election campaign next year. The Tea Party activists won a major victory in their effort to reduce the level of spending of the federal government in the amount and breadth of the deal. The loser in this compromise appears to be Speaker John Boehner. The Tea Party caucus members rejected his plan and their action forced the United States Senate to work out a compromise of their own. It will be interesting to see if the Speaker can retain the loyalty of the rank and file members or if they are emboldened to take more stances against the House leadership.

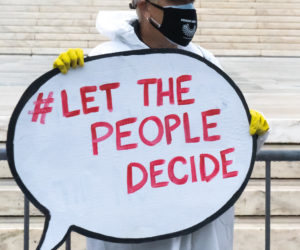

Both sides will make the case that the compromise was built upon their mission of restoring health to the American economy. Who won? Who lost? Who knows. For now, the political can was kicked in the neutral zone to become a campaign issue in next year’s election. It is the voters of 2012 that are going to have to decide who deserves the credit or the blame for this deal.

Faculty, Department of Political Science, Towson University. Graduate from Liberty University Seminary.