We can be certain that moderators in tonight’s CNN debate between Joe Biden and Donald Trump will feature a question related to taxes and not just because the 2017 tax cuts orchestrated by Trump have led to record deficits.

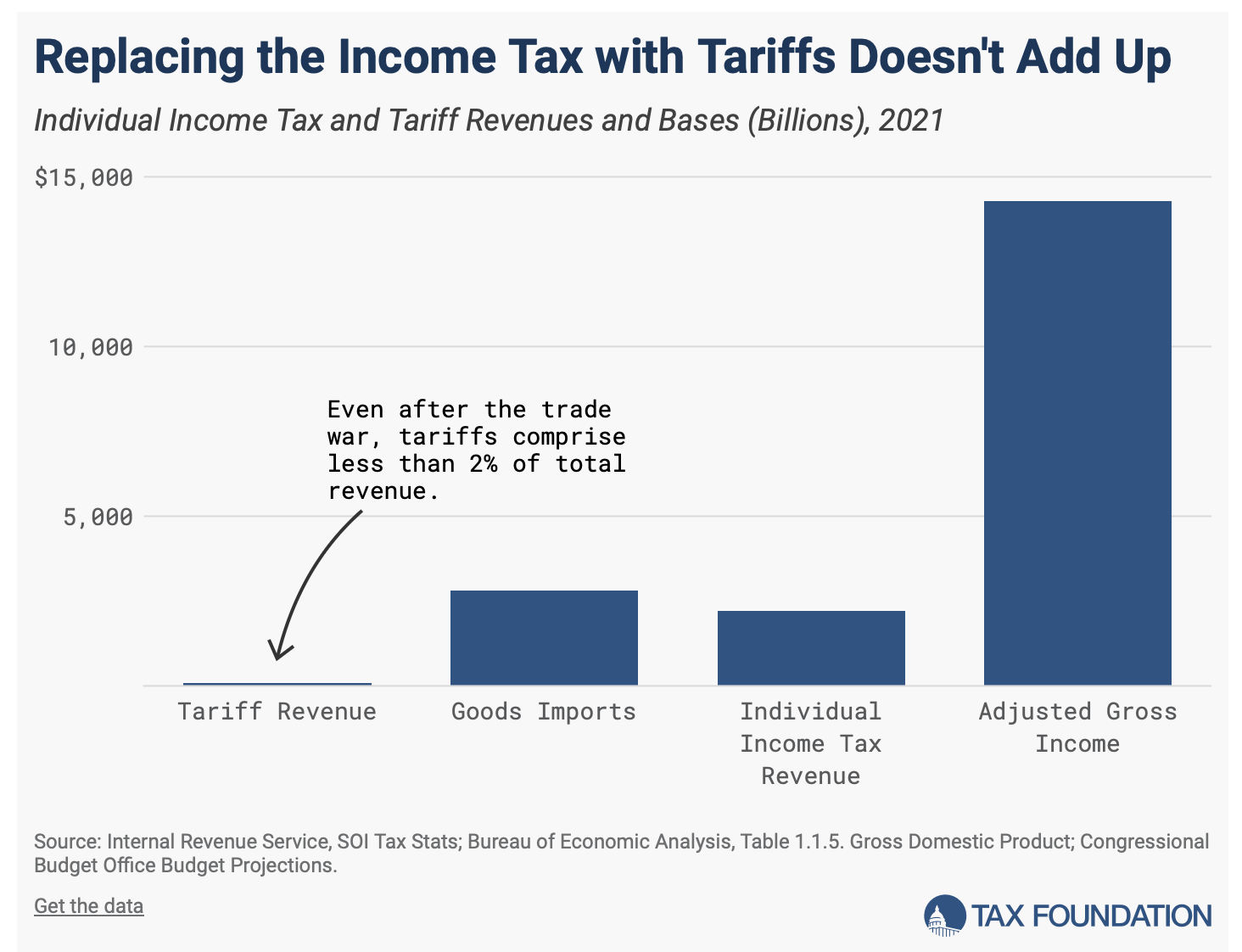

Last week, Trump suggested “entirely replacing the federal income tax with new tariffs.”

This chart shows why such a change would explode the deficit, make imports unaffordable, or both.

In other words, the consequences of this not-well-thought-out suggestion are beyond dire and would harm both businesses and individuals.

Project 2025 is a roadmap for second Trump Administration, and its consequences are also dire. Project 2025 would shift income taxes to consumption taxes (an extremely regressive policy).

It also proposes to “save” the budget into balance by privatizing the National Flood Insurance Program; withdrawing from international entities such as the World Health Organization and United Nations efforts; militarizing the Voice of America; and offloading to state governments the full costs of response to hurricanes, fires and floods as well as cybersecurity, for example.

The 2017 tax cuts

Trump and the GOP slashed corporate and upper income individual taxes in 2017, with the maximum corporate income tax rate set at 21 percent.

The new law was the “biggest tax overhaul since [Ronald Reagan’s] Tax Reform Act of 1986.” The 1986 law was “first time in U.S. income tax history that the top tax rate was lowered and the bottom rate was increased at the same time.

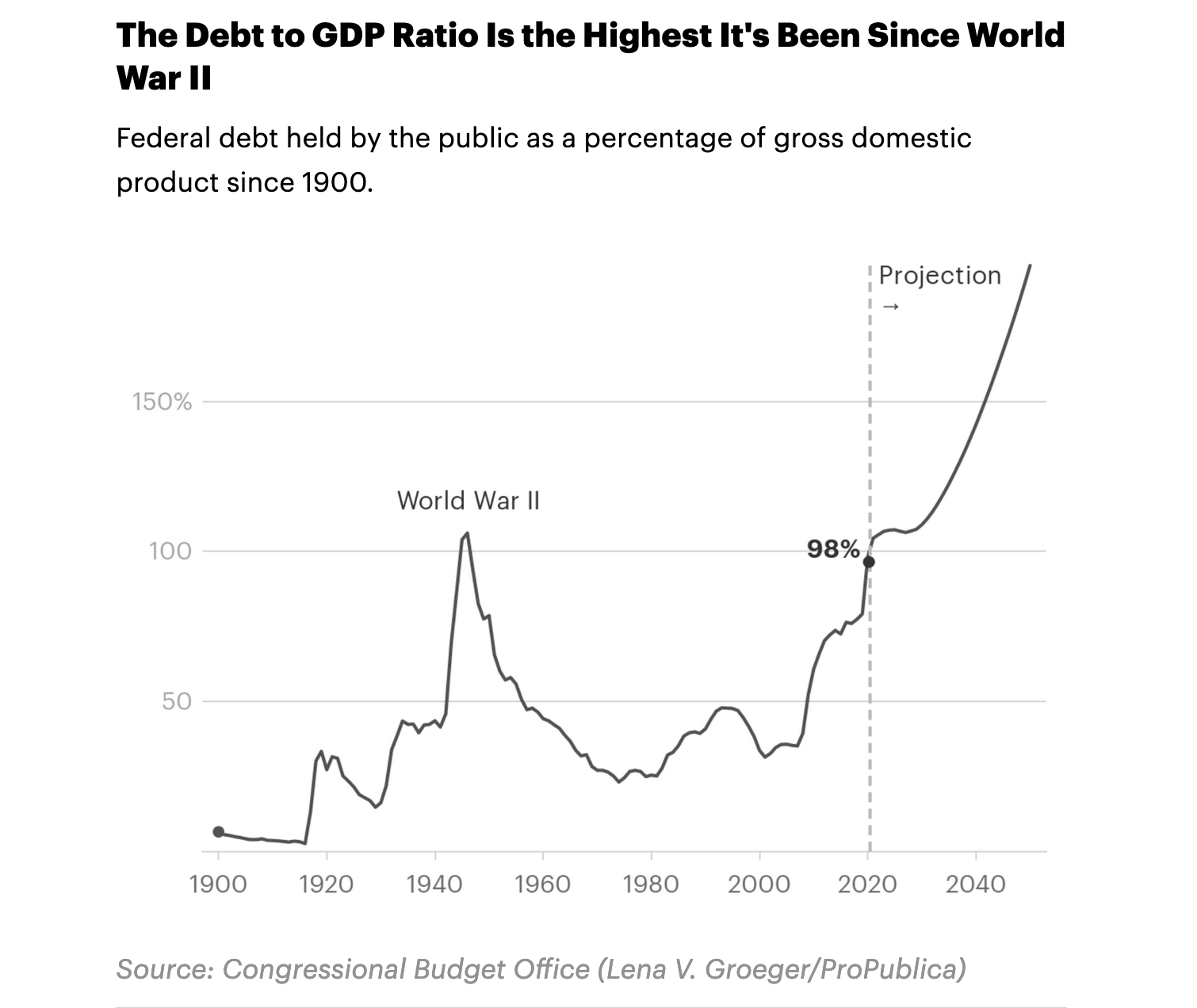

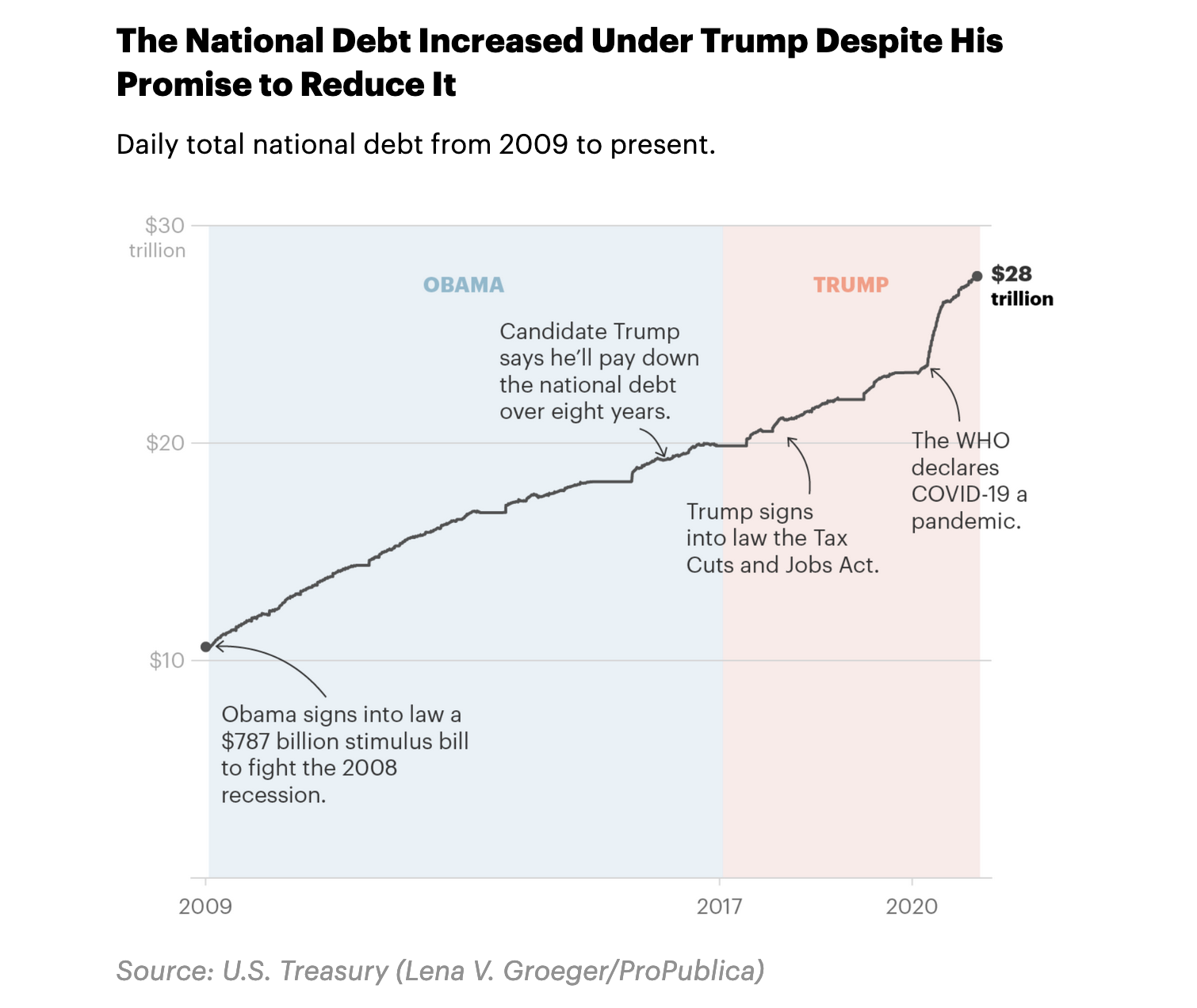

Consequently, the annual deficit under Trump is the third largest since George W. Bush (fighting in Iraq and Afghanistan) and Abraham Lincoln (fighting the civil war). “Trump did not launch two foreign conflicts or have to pay for a civil war” and yet the debt to GDP ratio in 2020 was the largest since WWII.

And what did Trump say in the 2016 campaign?

In a 31 March 2016 interview with Bob Woodward and Robert Costa of The Washington Post, “Trump said he could pay down the national debt, then about $19 trillion, ‘over a period of eight years’ by renegotiating trade deals and spurring economic growth.”

Didn’t happen, even before Covid.

Could not have happened given the 2017 tax cuts.

“Supply side” economics as a way to erase budget deficits was a myth when Reagan touted it and it’s a myth today.

Yes, Covid happened under Trump’s watch.

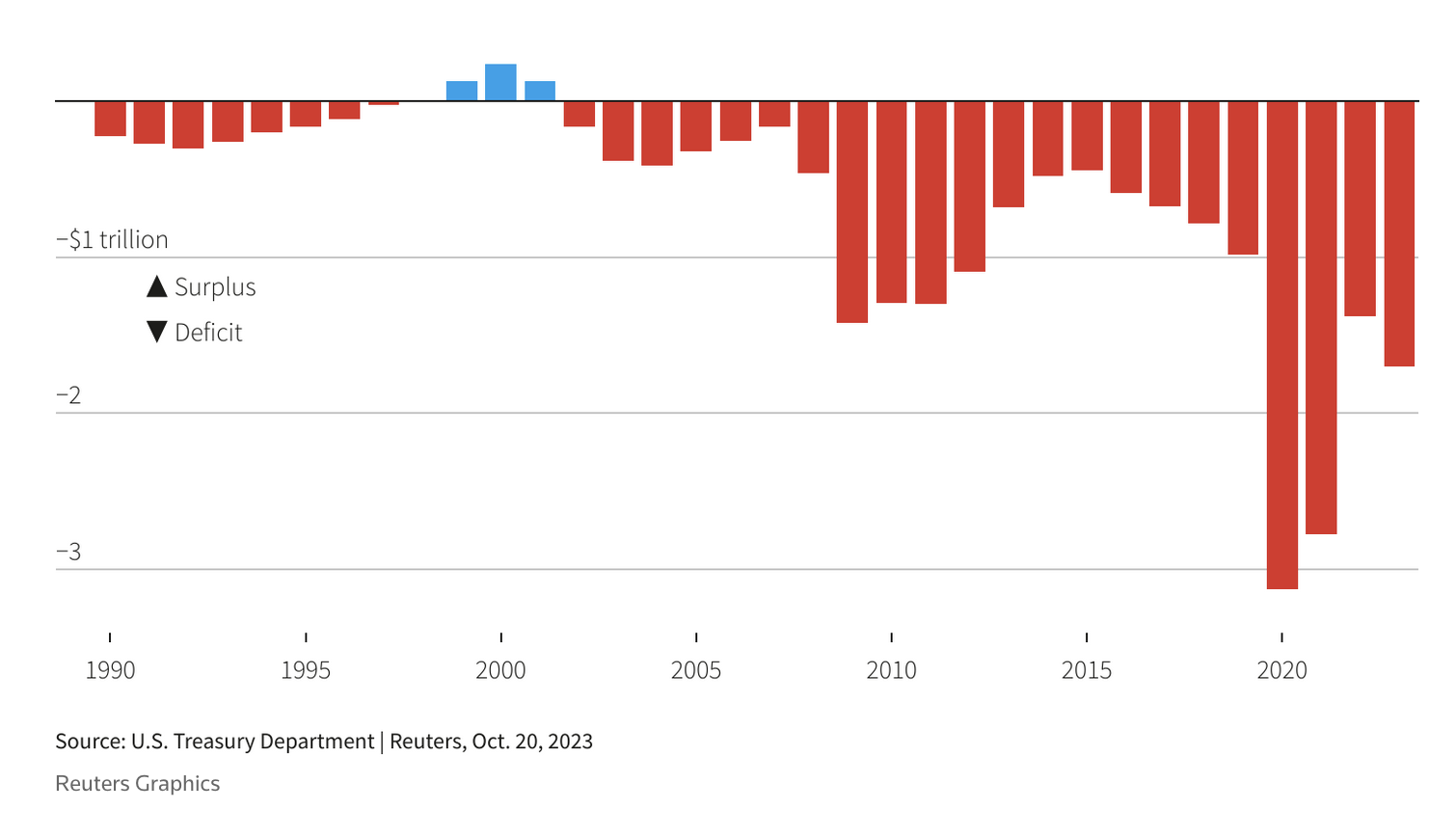

But the deficit for 2022-2023 was the largest shortfall ever (nominal dollars) except for 2020-21 and 2021-22, according to Reuters, and is a consequence of those 2017 tax cuts as the projection in chart two (2) shows.

Obama reduced deficits, even after assuming an economy brought to its knees under Bush 43. Trump increased the deficit every year he was president.

The 2017 tax cuts expire in 2015. Thus the vision Trump and Biden bring to that expiration is critical. Next installment: Biden’s tax vision.

Known for gnawing at complex questions like a terrier with a bone. Digital evangelist, writer, teacher. Transplanted Southerner; teach newbies to ride motorcycles. @kegill (Twitter and Mastodon.social); wiredpen.com