On Friday, Trump Media & Technology Group stock (DJT) closed at $61.96.

On Monday: $48.66.

That’s a 21.47% drop in one day.

The stock is a week old. It peaked at $66.22 last Wednesday. The company has lost 26.52% of that (extraordinarily unrealistic) value.

In what should be an SEC violation, the day before DJT began trading on NASDAQ an independent accounting firm issued a dire warning. Colorado-based BF Borgers CPA PC noted that “operating losses raise substantial doubt about [Trump Media & Technology Group] ability to continue as a going concern.”

The day before trading began.

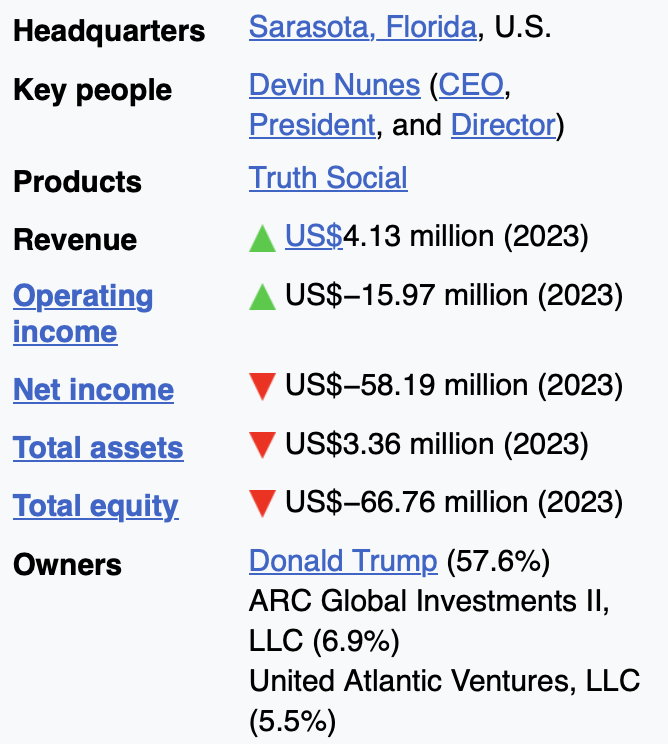

Truth Social, the company’s only product, has never turned a profit. It lost $58,190,000 on revenue of $4,100,000 in fiscal 2023.

Look, no one can claim being blindsided. As I reported on March 25, SEC filings from January showed that Truth Social had only $1.07 million in revenue during the third quarter of 2023. It had losses of $26 million.

Technology journalist Kara Swisher said going public was “an obvious scheme to pump money to Trump” because Truth Social is “a sinkhole and a non-start of a startup.”

History appears repetitious:

Fun Fact: The last time “DJT” was on the stock exchange it was “Trump Hotels and Casino Resorts” — and it lost money every single year of its existence before filing for bankruptcy in 2004.

— Mary L Trump (@MaryLTrump) April 1, 2024

How did Trump manage to double losses in a single quarter? Creative bookkeeping? Or creative loan payments? The largest expense was more than $39 million in interest. Let me remind you: on income of $4.1 million.

Cheating partners for profit

Creative accounting led to Trump posting a sizeable bond this week, albeit less than he owes the state of New York.

After a 10-week civil trial last year, New York Supreme Court Justice Arthur Engoron found Trump, the Trump Organization, Trump’s adult sons and two former executives guilty of “using illegal tactics to knowingly cheat business partners to increase the company’s profits and savings.”

[Isn’t withholding that independent assessment also a type of cheating new partners? If not, why not?]

On Monday, Trump posted a $175 million bond in that civil fraud case. The bond allows him to appeal the decision and stop New York State from seizing assets (like Trump Tower) for what he owes the state — $355 million in penalties plus interest totalling $454 million.

Who underwrote this bond? Knight Specialty Insurance.

Billionaire Don Hankey, Knight Insurance Group chairman, told The Associated Press that Trump provided “both cash and bonds … as collateral.”

According to MSNBC legal correspondant Lisa Rubin, Hankey is “believed to be the largest shareholder in Axos Bank.” In 2022, Axos gave Trump $225 million in 10-year loans for Trump Tower and Doral.

The insider baseball relationship mirrors the one hanging over Trump’s $92 million bond in the E. Jean Carro;; defamation suit.

The Axos statement to Fortune last year:

“The independently appraised value of each property significantly exceeds the related mortgage loan amount,” he said in a statement. “And the cash flow generated from each property’s operations far exceeds the debt service required to fully service the related mortgage loan.”

Quite an itemized debt (not exhaustive)

- $8 million owed WSFS Bank related to a guaranty related from 2000.

- $11.2 million owed to Professional Bank. (2017-2020 loan year; due date unknown).

- $45 million due to Deutsche Bank (estimate). Due 2024.

- $160 million due Ladder Capital; he still owed $126 million April 2023. Loan date: 2015

What’s next in the Trump finance chronicles?

Talk to me: BlueSky | Facebook | Mastodon | Twitter

Known for gnawing at complex questions like a terrier with a bone. Digital evangelist, writer, teacher. Transplanted Southerner; teach newbies to ride motorcycles. @kegill (Twitter and Mastodon.social); wiredpen.com