Campaign 2024 series: the stakes, not the odds

In 2021, the Boston Globe editorial board asked: “Who owns the president?”

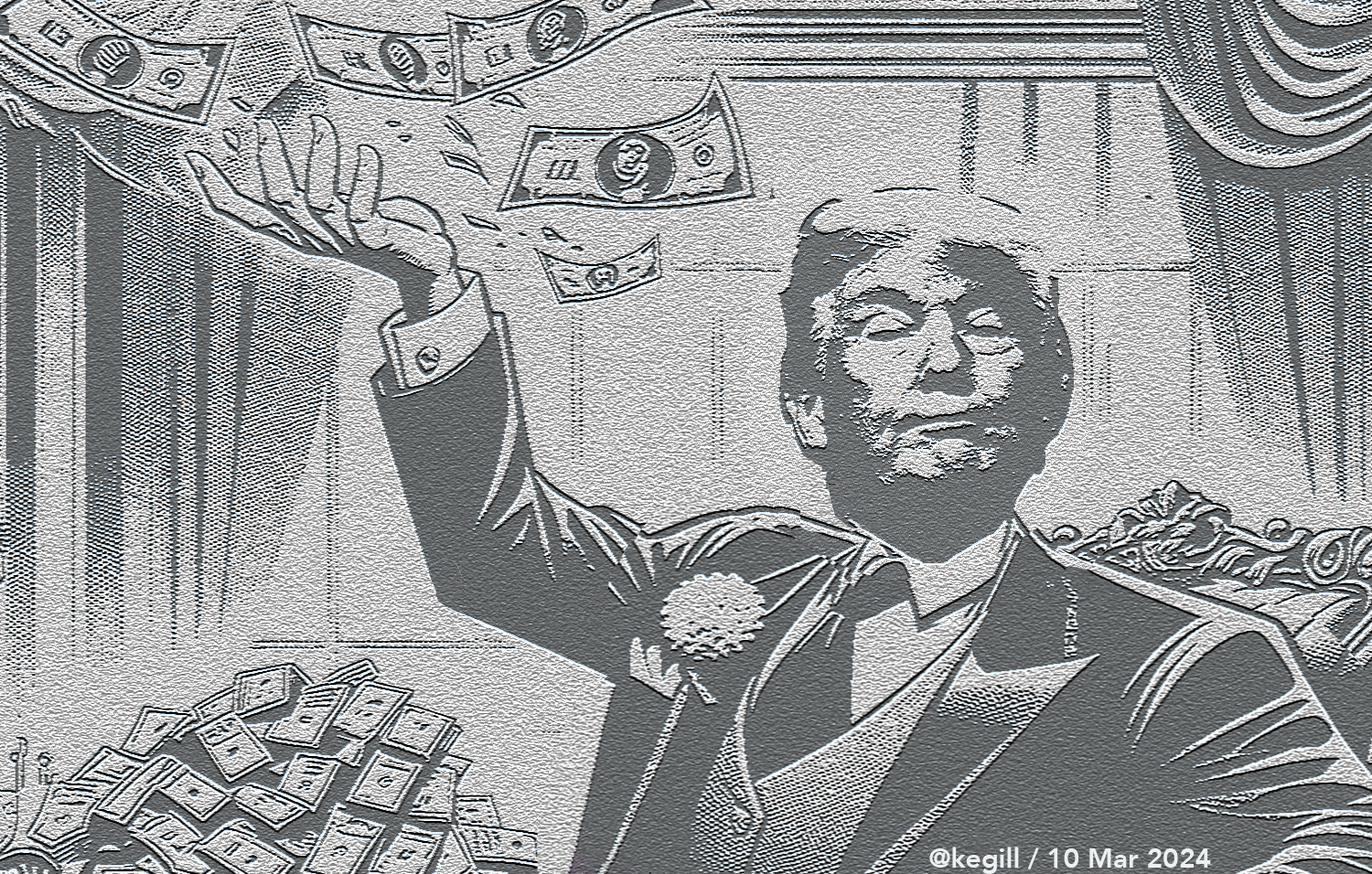

It’s a shame that the business press and political press aren’t exploring that question in light of Friday’s Truth Social multi-billion dollar merger.

Instead, the headlines read like something straight from PR Newswire:

- “Trump poised for billions” (BBC)

- “Trump could score $3.5 billion…” (CBS)

- “Trump is about to get $3 billion…” (CNN)

- “Trump stands to make $3.5 billion…” (Fortune)

- “Trump is on the verge of a windfall of billions” (NPR) and

- “Trump Is In Line for a $3.5 Million Windfall...” plus “Trump Makes a New Fortune… (WSJ).

Friday was the last business day before Donald Trump’s deadline to post a $454 million bond if he wants to appeal his loss in New York civil fraud case. He was found guilty of “inflating property values and lying about assets to receive loans and reduce taxes.” Eric Trump told Sunday Morning Futures on FOX that all potential bondsmen he talked to “were laughing. They were laughing… they want to bankrupt him.”

UPDATE, 9:15 am Pacific: The New York Times reports that a New York Appeals Court has lowered the bond requirement to $175,000,000. Trump has a 10-day extension to secure a bond.

The Daily Beast reported last week that New York Attorney General Letitia James has “quietly filed judgments … against the former president, his eldest sons Don Jr. and Eric, and several of their companies.”

Notably (or suspiciously), on Friday a special purpose acquisition (SPAC) company, Digital World Acquisition Corp. (DWAC), agreed to merge with Trump’s social media network, Truth Social.

“An IPO is basically a company looking for money, while a SPAC is money looking for a company,” according to Don Butler, Managing Director at Thomvest Ventures.

The merger was initially planned for 2021. DWAC raised only about $300 million in its IPO.

The merger takes Trump Media & Technology Group (TMTG) public. Trump holds more than 50 percent of the post-merger venture; on paper, that’s an estimated $3.5 billion. The merged venture will trade under the symbol “DJT.”

Why might DWAC’s shareholders be wary?

In 1995, “Trump Hotels and Casino Resorts used the same stock ticker [DJT] when it went public,” according to NBC News. That deal did not go well for stockholders.

Trump Hotels and Casino Resorts lost money “every year under Trump’s leadership” (1995 to 2009). Stock price peaked at $35; its low was $0.17.

The Washington Post reported in 2016 that the company lost more than a billion dollars. (A billion in 2009 would be $1.5 billion today.) Trump got a $5 million bonus “the year the company’s stock plummeted 70 percent.”

Not unlike Trump Hotels and Casino Resorts, TMTG lost $49 million during the first nine months of 2023. Half of those losses occurred in the third quarter.

And yet. Billionaire Wall Street financier and “Republican megadonor” Jeff Yass is DWAC’s biggest institutional shareholder, with a 2% stake via Susquehanna International Group, his trading firm.

What was impact of the TMTG merger announcement on DWAC stock? On 23 January 2024, it had hit a 52-week-high of $58.72 per share. It fell to $44.20 before the shareholder vote.

DWAC shares closed trading Friday afternoon at $36.94 per share, a 37% drop from its peak.

SEC filings in January revealed that Truth Social had only $1.07 million in revenue during the third quarter of 2023; losses, $26 million. In comparison, Twitter’s revenue for the same period was an estimated $688 million. Meta: $34.1 billion.

There aren’t many institutional holders of Truth Social. Its shareholders are mostly individual investors, numbering some 400,000. But here’s where things get crazy. These investors are all fanatical about the stock and have pushed its value on paper into the stratosphere, despite no financial foundation.

In short, Truth Social is part of the “meme” stock frenzy that helped lift shares of companies like GameStop to ridiculous valuations by using social media to hype the stock ever higher—before it crashed back down to earth.

Truth Social is a speculative investment bubble that will reward those who can cash out at the high and punish those who are left holding the bag at the end.

Why should voters be concerned?

The merger created a new company. Trump is not supposed to sell any of its stock for six months. Called a lock-out, this is a common prohibition setup to protect new stockholders (encourage them to buy) by preventing insider stockholders from dumping their stock.

The new board of directors reportedly includes Donald Trump Jr. and others in the Trump orbit. This new board can change the terms of the lock-out agreement to benefit Trump.

Should Trump return to the White House, voters must consider how “a monetized president” (Jay Kuo) could be manipulated by holders of stock. “Do this, we’ll buy stock and drive up its value. Do that, we’ll sell stock and drive down its value.”

Will there be any restrictions on who can own stock in DJT? Such limitations would be difficult to enforce, particularly if there are intermediaries or big funds involved. This means the Russians, Chinese and Saudis could each take huge institutional stakes in DJT as a publicly-traded company very much tied to the possible future president.

This would make the notion of foreign governments renting rooms at Trump hotels look quaint by comparison. Imagine come 2025 that big, wealthy buyers hold commanding stakes in Trump’s net worth, and he is now the president. What wouldn’t he do to stay in their good graces? Our jurisprudence around the Emoluments Clause isn’t set up to handle such a situation.

It’s not just foreign stockholders voters need to be concerned about. Domestic billionaires can hold stock, too, and probably will so long as it gets them access and leverage.

For example, Yass, a former vice chair of the CATO Institute Board of Directors, is also a major investor in TikTok’s parent company.

“Trump’s about face on banning the app may have resulted from pressure from Yass,” Kuo wrote.

That’s the national security issue: a publicly-traded candidate.

“Not the odds, but the stakes.” That’s how Jay Rosen, NYU journalism professor and media critic, thinks news organizations should be covering the 2024 presidential election.

“The stakes, of course, mean the stakes for American democracy,” Rosen told Oliver Darcy, CNN, last year. “The stakes are what might happen as a result of the election.” Rosen continued: “The horse race [odds] should not be the model… It should not be the organizing principle of your campaign coverage.”

This is my fifth report focused on the stakes facing voters in this presidential election.

Talk to me: BlueSky | Facebook | Mastodon | Twitter

Known for gnawing at complex questions like a terrier with a bone. Digital evangelist, writer, teacher. Transplanted Southerner; teach newbies to ride motorcycles. @kegill (Twitter and Mastodon.social); wiredpen.com