This weekend’s New York Times endorsement of Hillary Clinton should remind Iowa voters that Clinton is the candidate of the establishment.

Being part of the establishment comes with entanglements, beholden-ments … bindings to powerful institutions and the people who head them.

It’s the opposite of change, whether radical, transformative or disruptive.

This is business-as-usual, more-of-the-same.

So if “stay the course” is your mantra, particularly when it comes to Wall Street, Clinton is the logical candidate.

The ties that bind: finance

Simon Head, writing in The New York Review of Books this weekend, reminds us that one of those entanglements is with the institutions that brought the world’s economy to its knees less than 10 years ago.

In mid-2014, David Corn spotlighted Clinton’s connection to Wall Street.

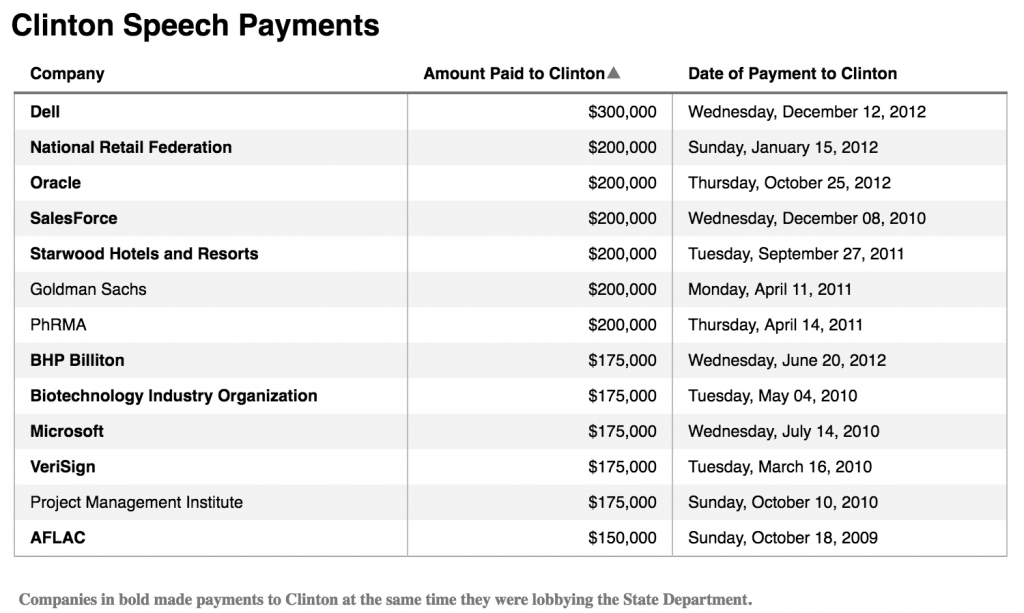

Can the former secretary of state cultivate populist cred while hobnobbing with Goldman and pocketing money from it and other Wall Street firms? Last year [2013], she gave two paid speeches to Goldman Sachs audiences. (Her customary fee is $200,000 a speech.)

In late 2015, a NY Times reporter lamented:

Mrs. Clinton’s windfalls from Wall Street banks and other financial services firms… have become a major vulnerability in states with early nomination contests… It is an image problem that she cannot seem to shake.

In mid-January, the NY Times noted that Clinton had raked in $2 million in less than seven months giving speeches to Wall Street firms. In 2013, she took in $3.15 million by speaking to firms like Deutsche Bank, Goldman Sachs, Morgan Stanley, and UBS. In the past two years, Bill and Hillary have earned $25 million in speech income.

Clinton Foundation donors bleed green

Financial sector ties may be most troublesome in the context of Clinton Foundation finances. Head writes:

According to a February 2015 analysis of Clinton Foundation funding by The Washington Post, the financial services industry has accounted for the largest single share of the foundation’s corporate donors. Other major donors to the foundation have included US defense and energy corporations and their overseas government clients…

Big donor contributions mean access.

I examined the Clinton Foundation’s donor report, which shows cumulative lifetime giving through September 2015. Of course, there are the obvious links with Wall Street, like the Goldman Sachs Foundation.

But hidden in plain sight are extensive links to the global financial sector. I say “hidden” because many are not household names or because a philanthropic group has its roots in finance.

These Clinton Foundation donors are linked to the financial services sector. I was curious about individuals who had the net worth to donate between $1-5 million, so I checked out all of them. There were no indviduals making donations greater than $10 million; I did not check the bona fides of individuals making donations of less than $1 million.

-

Contributions between $5 million and $10 million

John D. MacKay - Contributions between $1 million and $5 million

100 Women in Hedgefunds, Barclays Capital, Barclays PLC, Bernard L. Schwartz, Bloomberg Philanthropies, Citi Foundation, Carlos Bremer, Christy and John Mack Foundation, The Eli and Edythe Broad Foundation, The ERANDA Foundation (Sir Evelyn de Rothschild), Fidelity Charitable Gift Fund, General Electric, Gerardo Werthein, The Goldman Sachs Group, Inc., HSBC Holdings, Inter-American Development Bank, Jay Alix, Joachim Schoss, Jonathan and Jeannie Lavine, Mala Gaonkar Haarmann, Nima Taghavi, Raj Fernando, Richard Blum and Blum Family Foundation, Robert Disbrow, Robertson Foundation (Julian and Josie Robertson), Salida Capital Foundation, The Sherwood Foundation (Susan A. Buffet), Standard Chartered Bank, Sterling Stamos Capital Management, LP, Swiss Reinsurance Company, T.G. Holdings, Victor P. Dahdaleh, and Wallace W. Fowler - Contributions between $500,001 and $1 million

Bank of America Foundation, Citigroup Inc., McKinsey & Company, UBS Wealth Management USA, Visa Inc., and Western Union Foundation - Contributions between $250,001 and $500,000

Banco Santander Brasil S.A., BMCE Bank, Deutsche Bank AG, Deutsche Bank Americas, Goldman Sachs Philanthropy Fund, Jay Alix, Morgan Stanley Smith Barney Global Impact Funding Trust Inc., and U.S. Global Investors, Inc. - Contributions between $100,001 and $250,000

American Express Travel Related Services Company, Attijariwafa Bank, Bank of America Corporation, Banque Centrale Populaire, Cherokee Investment Partners, Chopper Group [Chopper Trading, Llc], Equity Bank Limited, Groupe Credit Agricole du Maroc, JPMorgan Chase & Co., Lehman Brothers Holdings Inc., Merrill Lynch & Company Foundation, Inc., Mastercard Foundation, Moody’s Corporation, Morgan Stanley, Quadrant Capital Advisors, Inc., Swiss Re America Holding Company, TIAA-CREF, Wells Fargo Foundation, and Zenith Bank

Not a new concern: in 2008, NPR hinted that foundation donations could be a conflict of interest:

One of the questions that has come up over the course of this campaign is the amount of money, the millions and millions and millions of dollars that Bill Clinton has raised for his foundation … Some lists have leaked out, but we don’t know who is giving money, how much. And there can be questions of conflict of interest there…

The ties that bind: appearance of payment-for-favors

Head calls out an April 2015 analysis from the International Business Times.

Former President Bill Clinton accepted more than $2.5 million in speaking fees from 13 major corporations and trade associations that lobbied the U.S. State Department while Hillary Clinton was secretary of state, an International Business Times investigation has found. The fees were paid directly to the former president, and not directed to his philanthropic foundation.

Speaking fees to spouses appear to be exempt from “conflict of interest” rules.

“There isn’t an ethics rule that prohibits someone like Bill Clinton from charging exorbitant speaking fees and collecting those speaking fees from businesses that have interests before the administration,” Craig Holman told IBT reporters.

The big are getting bigger

Remember: the Clinton administration chief economic advisor, Robert Rubin, previously chaired Goldman Sachs.

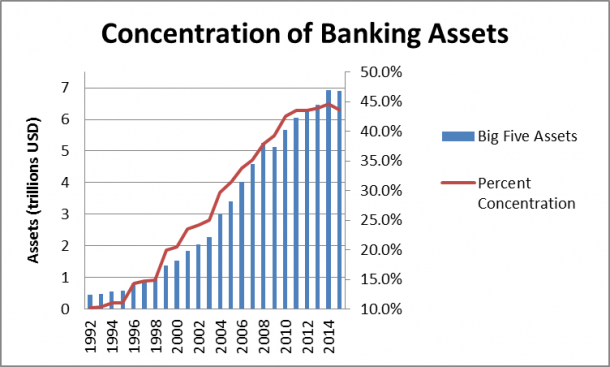

These cozy ties with the world of finance (which includes banking, insurance, “investments” and restructuring companies “in crisis” and which has historically been centered in New York City) are not new. Maybe that explains why American mainstream media seem to be ignoring these links even though bank consolidation is worse today than in 2007.

[S]ix years after the banking system blew up the five biggest firms [Bank of America, Citigroup, JPMorgan Chase, US Bancorp and Wells Fargo] control 44% of the $15.3 trillion in assets held by U.S. banks.

In 2007, the five largest U.S. banks were Citi, Bank of America, JP Morgan Chase, Morgan Stanley and Wachovia.

After the financial collapse, only two stand-alone investment banks remain: Morgan Stanley and Goldman Sachs Group, Inc.

Since 1992, total assets held by the five largest U.S. banks has increased by a factor of 15. The big have have gone from holding less than 15% of all US banking assets to almost 45%.

Asset concentration began in earnest after the 1999 repeal of Glass-Steagall (Democrat Bill Clinton + a Republican Congress). Congress passed Glass-Steagall in the wake of the great depression, forcing investment and commercial banking activities to be separate.

At the time, “improper banking activity,” or what was considered overzealous commercial bank involvement in stock market investment, was deemed the main culprit of the financial crash.

In other words, speculation … behavior at the heart of the 2007 crash.

Another cause of the Great Depression, according to Ferdinand Pecora, lead counsel for the Senate Banking and Currency Committee investigation, was “conflicts of interest and fraud … among elite finance and government officials.”

The Pecora investigations provided the factual basis that produced a consensus that the financial system and political allies were corrupt… The investigations discredited the elites that benefited from that system and were blocking reform.

The collapse of 2007 had no corollary to the Pecora investigation in the U.S. although Iceland has sent 26 bankers to jail.

With extensive ties to finance that stretch back 30 years, can Hillary Clinton be counted on to rein in Wall Street? I think not.

Known for gnawing at complex questions like a terrier with a bone. Digital evangelist, writer, teacher. Transplanted Southerner; teach newbies to ride motorcycles. @kegill (Twitter and Mastodon.social); wiredpen.com