The SEC has temporarily banned short-selling of 799 financial stocks.

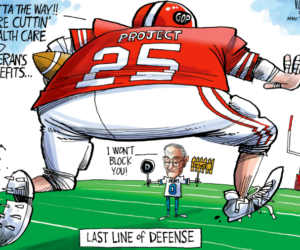

Maybe you don’t know what short-selling is. Here’s the funny explanation first:

Now here’s the not-so-funny explanation.

Essentially, buying a stock is betting the price will go up. Short-selling is selling shares you don’t actually have, betting the price will go down, and you can “buy to cover” later. One thing to remember: when you buy, you can only lose as much as you spent but your gains are theoretically-limitless; when you sell short, you can lose a theoretically-infinite amount of money, but your gains are limited. This is not a strategy for Joe and Jane Average.

It remains to be seen whether this will actually help the financial stocks in question. Some people do think it’s a bad idea and there were other ways to solve the problem.