You can always tell when a new political narrative is being created, because it suddenly starts to pop up everywhere. When Jon Kyl told Chris Wallace that spending has to be paid for but tax cuts do not, he caused a momentary flutter in conservative circles. But that didn’t last long. This morning, lo and behold! What do we see in the Wall Street Journal? An op-ed by Brian Riedl under the headline, “The Bush Tax Cuts and the Deficit Myth.” Riedl, if you’re wondering, is a budget “expert” employed by The Heritage Foundation.

Also today, we discover that the entire Republican leadership is coming together to chorus in unison the freshly birthed theme song:

For weeks, Senate Republicans have filibustered an extension of unemployment benefits on the grounds that Democrats aren’t willing to cut spending or raise taxes to pay for them. At the same time, the Bush tax cuts are set to expire, and Republicans want them to be renewed. For two days, Senate Minority Whip Jon Kyl has raised eyebrows by insisting that emergency aid to unemployed people — what he called a “necessary evil” — be paid for through either tax hikes or spending cuts, while the tax cuts (which mostly benefit wealthy people) not be offset in any way. Yesterday claimed that this view is shared by “most of the people in my party.”

He was correct.

“That’s been the majority Republican view for some time,” Minority Leader Mitch McConnell told TPMDC this afternoon after the weekly GOP press conference. “That there’s no evidence whatsoever that the Bush tax cuts actually diminished revenue. They increased revenue, because of the vibrancy of these tax cuts in the economy. So I think what Senator Kyl was expressing was the view of virtually every Republican on that subject.”

Paul Krugman wonders what’s the use of trying to prevail against this “invincible ignorance” — but he tries anyway:

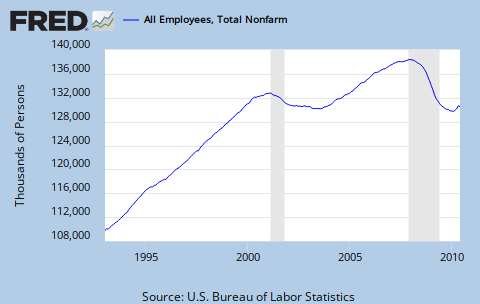

But anyway, look: it’s been a long time since Morning in America. We’ve now been through two two-term administrations, one of which raised taxes, the other of which cut them. Which looks like it presided over a more vibrant economy?

And who in their right mind would describe the Bush economy as “vibrant”, anyway? Even during the peak of the housing bubble, it never achieved the kind of job growth that was routine in the Clinton years.

I’m sure that people like Paul Krugman and Ezra Klein get discouraged more than they show — which is why when they do show it, I feel both less alone and more worried:

There are fiscal theories that I disagree with, and that I think are cruel, and that make me upset. But very few actually make me sad. Sen. Mitch McConnell, however, hit my sore spot today. “There’s no evidence whatsoever that the Bush tax cuts actually diminished revenue,” he told Brian Beutler of TPMDC. “They increased revenue because of the vibrancy of these tax cuts in the economy. So I think what Senator Kyl was expressing was the view of virtually every Republican on that subject.” In other words, this is why Republicans don’t think tax cuts need to be paid for. They pay for themselves.

Why does this make me sad? Because it’s hard to see the country prospering when one of its two major political parties is this economically illiterate. McConnell isn’t some backbencher. He’s Senate minority leader. And he thinks there’s “no evidence whatsoever that the Bush tax cuts actually diminished revenue.”

There’s an ontological question here about what, exactly, McConnell considers to be “evidence.” But how about the Congressional Budget Office’s estimations? “The new CBO data show that changes in law enacted since January 2001 increased the deficit by $539 billion in 2005. In the absence of such legislation, the nation would have a surplus this year. Tax cuts account for almost half — 48 percent — of this $539 billion in increased costs.” How about the Committee for a Responsible Federal Budget? Their budget calculator shows that the tax cuts will cost $3.28 trillion between 2011 and 2018. How about George W. Bush’s CEA chair, Greg Mankiw, who used the term “charlatans and cranks” for people who believed that “broad-based income tax cuts would have such large supply-side effects that the tax cuts would raise tax revenue.” He continued: “I did not find such a claim credible, based on the available evidence. I never have, and I still don’t.”

There’s more; read it all.

I’ll end with this brief quote from Last Call: The Rise and Fall of Prohibition, by Daniel Okrent, which I am almost finished reading. The quote refers to members of a right-wing group of wealthy businessmen called the Liberty League:

“Roosevelt could not have wished for a better foil than this alliance of multimillionaires profoundly out of touch with the agonies the Depression had imposed on most Americans. … He was proud, the president said, to have earned ‘the hatred of entrenched greed.’ “

PAST CONTRIBUTOR.