A Rational And Affordable Process To Solve The Nation’s Banking Crisis

by Marc Pascal

Today all economic and financial experts are essentially baffled on how to proceed in cleaning up the remnants of the Gambling Casino that was once the U.S. banking and financial system. We have zombie banks (BoA, Citigroup, etc.) and a U.S.-owned insurance giant (AIG) that have turned into black holes for taxpayer bailouts. Hundreds of billions of dollars have disappeared in less than a year and we are no better off than when we started.

Some experts claim that having allowed Lehman Brothers to fail last year was a mistake and was a major unsettling event in the interlocking global financial system. However, it was simply the first house of cards to be fully exposed. Letting it fail was merely a wake-up call that many other financial institutions were essentially bankrupt as well. The Lehman debacle is not a valid rationale to continue pouring billions of dollars into the other basket cases. We have been rewarding gross incompetent, intentional fraud and greedy management for massive failures with no corresponding benefits inuring to the general public.

The Swedish model is cited as a good option as a way out of this morass. It consisted of a quick public takeover (nationalization) of failed national banks that ultimately worked as they re-privatized in good financial shape. That model involved much smaller financial institutions that were no where the size or the global reach of our zombie banks. The U.S. has a reasonable aversion to doing anything “socialistic” unless every other viable capitalistic option is exhausted. The public just doesn’t want to be left holding the bag for this mess.

The Canadian model is also cited. Fortunately its national regulations of a handful of nationwide banks have kept those financial institutions relatively unscathed while the banking systems around the world are drowning. The Canadian banks do have various investment arms but the central government long ago limited leverage and the ability to fully partake in the orgy of mortgage-backed securities, credit default swaps and other risky misadventures that consumed much of the globe. However the U.S. system is much larger and more decentralized than its Canadian counterpart. It may be a system that the U.S. may wish to emulate after we clean up our mess but it is not a recipe for solving our current crisis.

The Federal Reserve Chairman Ben Bernanke and others have warned of dire consequences if we do not keep our zombie banks afloat, no matter the massive cost. They claim that the ripple effect of failure would have global repercussions. However, looking at the facts, the ripple effects of this severe recession has already gone global. Our past and current efforts to spend gobs of money propping up entities merely add to the recession. They simply have no credibility and engender no trust among the public to be worthy of further public support.

The billions spent on bank bailouts could be put towards stimulus spending on infrastructure, education, energy and healthcare, and even some temporary tax cuts, or at least cutting the federal deficit. Instead, these bailouts only exacerbate our estimated deficits as far as the eye can see. If and when recapitalization might be accomplished, we would have sunk trillions of dollars into worthless paper when it could have gone toward tangible things that actually provide long-term benefits to the American people and our private enterprise system.

A banking and financial system exists to provide credit and financial services to businesses, households and individuals. It must be trustworthy, well-managed, transparent, ethical, and sufficiently flush with cash to operate and play its important role in any national or global economy. All the tax cuts and spending programs will not end any recession if the financial and banking system is still a mess.

The “stress test” proposed by the new Treasury Secretary is merely a cover to eventually liquidate or nationalize these institutions. It is not even sufficiently objective, rigorous, or publicly transparent to provide any meaningful information. At least before moving in this direction, they can have their Claude Raines wonderfully sarcastic Casablanca moment. “I’m shocked…shocked to find that there is gambling going on in here.”

There is one major underlying problem with assessing the many toxic assets based upon bundled mortgages and other types of loans.

Much of the underlying paperwork is missing. Moody’s and Standard & Poor’s finally admitted to having the same problem several years ago when trying to rate those derivative securities. The analysts were told by top executives in the financial sector they were rating and by their own managers to ignore that glaring omission. Not only subprime loans are failing, but due to mounting unemployment, standard and prime mortgages, car and student loans, and many credit cards, may also default. (If you think our financial system is under stress now, just wait another 6 months.)

So what is a viable and comprehensive national alternative? Insanity is defined as doing the same thing over and over but expecting a different result. With regards to our banking and financial sector, we are flailing about and acting insanely. Now it is time for a reasonably sane proposal based on sound business principles.

The Federal Government has to fill this massive banking void and temporarily provide this country with a viable, independent, trustworthy, and parallel banking and financial entity. It would be principally managed by the private sector, but rationally and fairly regulated for the benefit of all Americans and U.S. private enterprises. There may be some small regional banks that have largely been unscathed by the current financial crisis, but they cannot be the sole means to restore the entire national financial system.

Two things must be pursued simultaneously. One is novel for today but actually based on our past history and supported by Alexander Hamilton. The other is simply inevitable.

The Federal Government should charter a new national bank, initially owned by the Federal Government but scheduled within 2 years to be privatized. The Federal Reserve would initially loan it about $150 billion to establish its initial cash reserves. This would be a bargain compared to our efforts for AIG where we’ve already dumped $130 billion into a black hole.

The balance sheet of the new national bank would be pristine and completely free of any toxic assets or bad debts. It would open branches in every American city and be accessible on the Internet. There are plenty of empty bank buildings and many highly qualified unemployed people with extensive financial and banking experience who can quickly get this entity up and running with the proper private-sector mindset yet dedicated to serving the public at large.

The new national bank would accept deposits from businesses, individuals, governments and institutions from anywhere in U.S. and the world, all fully insured up to $250,000 as would any other banking institution. Within this bank, there would be several separate operating divisions: (1) Commercial financial services including business loans and commercial paper, (2) student loans, (3) home mortgages, loan purchase, refinancing and consolidation services, and (4) management for tax-deferred retirement accounts. It would not have any investment banking or brokerage divisions. It would not issue any credit cards but debit cards would be attached to all checking accounts. Its loan standards and account policies would serve as national models on how to treat the general public.

Within a year from its original charter, 40% of its ownership would be distributed to those with established savings accounts based on a formula that would issue a certain number of common stock for specified amounts held in long-term deposits. Within a year after that initial partial privatization, another 50% of its common stock would be offered to the general public in a standard public offering. The Federal Government would retain a 10% interest in the bank for at least another 3 to 7 years until the bank proves itself to be fully competent to protect shareholders, depositors, employees and the general public.

Initially the 7-member board of directors would consist of individuals with no conflicting interests in any other U.S. financial institutions. They would be appointed by the Chairman of the Federal Reserve, The Treasury Secretary, The Commerce Secretary, The Chairman of the SEC, and the President of the U.S. Two permanent board positions would be required to protect the general public. One would be appointed by the Chairman of the Federal Reserve and the other would be elected by all non-executive employees of the bank. As the bank moves towards private ownership, the other 5 members would naturally be elected by the shareholders, using cumulative voting rules to protect the interests of minority shareholders.

Some would say that the new federal bank would draw away a significant amount of money from the old zombie banks and other financial institutions. Exactly true because businesses, individuals and investors need a trustworthy place to put their money. This bank’s future lending capacity would be dictated by how much is deposited by the private sector, and by new strict leverage regulations imposed by the federal government. By ensuring a wide public ownership, this national bank would remain a major national and international financial institution for decades. In these very uncertain economic times, people need a place where they can safely conduct their financial affairs. This new federal bank would be an excellent place to start our recovery from this deep recession.

At the same time the new federal bank is being created, the federal government should create a special liquidation and bankruptcy court, setting up an entity to hold all toxic assets and bad debts called the “Amalgamated Trust.” Then the zombie banks and other financial institutions that are essentially bankrupt will put thru this special reorganization and liquidation process.

All of the mortgages and loans that are in foreclosure or default, will likely default, or are based upon real estate worth less than their face values, would be sold to other viable banks, private investors, and the new national bank at a discount rate determined by the Amalgamated Trust. Only when fixed prices are set for all the bad loans can a bottom be determined and the endless bleeding stopped with respect to these financial institutions.

Yes, under this plan bank shareholders would be wiped out but that is normal and just in any capitalist system. Many of the investors who are linked to various toxic assets held by the zombie banks will also suffer. But they should have bothered to assess the overall risks better. There would be a global ripple effect, but there already is a huge one now. We have to let the capitalist system do its normal dirty work in order to restore confidence in that same capitalist system. We cannot cover up its failings by using public funds or nationalizing those debts to the public’s detriment.

Overall the situation can’t get any worse, and if it does, then it would be only temporary. By fixing a date to end the pointless bailouts and set objective values on the toxic assets, we will prevent the necessary and eventual banking reorganization process from dragging out for years, bringing our global economy down with it. The sooner these huge bankrupt financial institutions are liquidated, the sooner we can move towards a viable economic recovery.

One major benefit would be that under current law, the special liquidation and bankruptcy court could look back 6 years and try to recoup all those questionable salaries, bonuses and commissions paid to executives and employees before and while those entities were losing billions of dollars. This would be the best way to establish a minimal level of accountability, responsibility and financial punishment that would be deemed fair and appropriate by the general public.

Some may argue that the federal government would be unfairly competing with the private sector. The only response to such a claim is that today we have no viable and trustworthy private banking system. A good part of what’s left should be liquidated.

A new National Infrastructure Bank for investing in public roads, schools, highways, bridges, airports, seaports, mass transit, high speed and conventional rail, and new energy sources and technologies, would also be another key component of our national recovery. The sale of its tax-exempt government-insured bonds would be a great new investment vehicle for the general public and global investors. It certainly would provide greater long-term public benefits and provide safe, steady returns based upon building tangible assets. It would not exist to trade in worthless paper and overpriced assets as our prior bubble investments did during the past few decades.

Finally, a new trust fund of about $10 billion should be established and distributed to qualified venture capital firms and local SBA development centers. It would provide seed capital to start-up private companies and existing small enterprises that would eventually expand across the country and around the globe. The driving engines of our capitalist system are new businesses that employ people in providing viable new products and services. This was an unfortunate spending omission from the recent stimulus package, missed by both Republicans and Democrats.

Despite their responsibility in causing their own downfalls and our current recession, and facing complete liquidation, many bank executives and shareholders might wail “But you can’t.” On behalf of the American people, Congress and the Administration should simply respond “Yes we can.”

Our only choice may be to create a viable, trustworthy and parallel new financial system and contemporaneously liquidate the old. We cannot afford the insanely expensive alternatives we are pursuing today. The entire transition process should be accomplished promptly and with the best interests of the American people in mind.

Marc Pascal obtained his J.D. and M.B.A. degrees more than 15 years ago. He worked for several years as an in-house legal counsel for two different corporations. He also started 4 new business ventures with friends. Since 2006, he has been an independent management and business consultant serving various private enterprises in the Phoenix area. He also posts weekly on TMV.

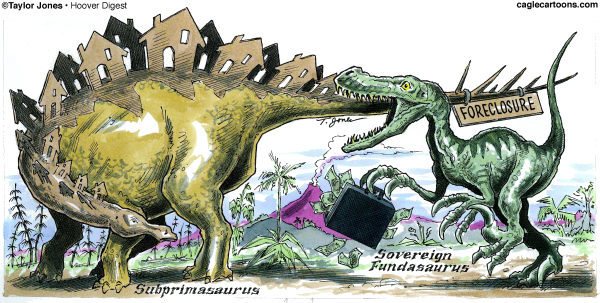

Cartoon by Taylor Jones, Hoover Digest. This cartoon is licensed to appear on TMV. All Rights Reserved. Unauthorized reproduction prohibited.