Since President Obama vowed to repeal the Bush tax cuts, there has been an increase in the ever-lasting clash over how much taxes the rich should pay. Obama was calling for taxes to be raised on the highest income bracket to be approximately 50 percent. Bill Maher defended this call for higher taxes, and pointed out that the taxes on the upper middle class bracket were actually considerably higher under President Eisenhower.

Senator Bernie Sanders made a similar comparison. During a Democratic debate, the interviewer points out that Senator Sanders has called for taxes over 50 percent on the top income bracket. When asked how much higher, Sanders replies with a claim, that it would be less than the amount under President Eisenhower. Sanders joked during a Democratic primary “I’m not that much of a socialist compared to Eisenhower.” At a rally, Trump warned the audience “he’s (Senator Sanders) gonna tax you people at 90 percent.” An article from Politifact, backs Sander’s claim that under Eisenhower, the top tax bracket was 90 percent.

The usual target for tax increases is the top financial bracket, which is currently 39.60 percent for those earning $418,400+. Taxes of this bracket were at 90 percent under Eisenhower. Senator Sanders claims his tax plan is actually nowhere near what Eisenhower, a Republican president mandated for taxes. What Senator Sanders is proposing is not even close to what Eisenhower did, right? If Eisenhower supported it, it should be good enough for all Americans, conservative or liberal right?

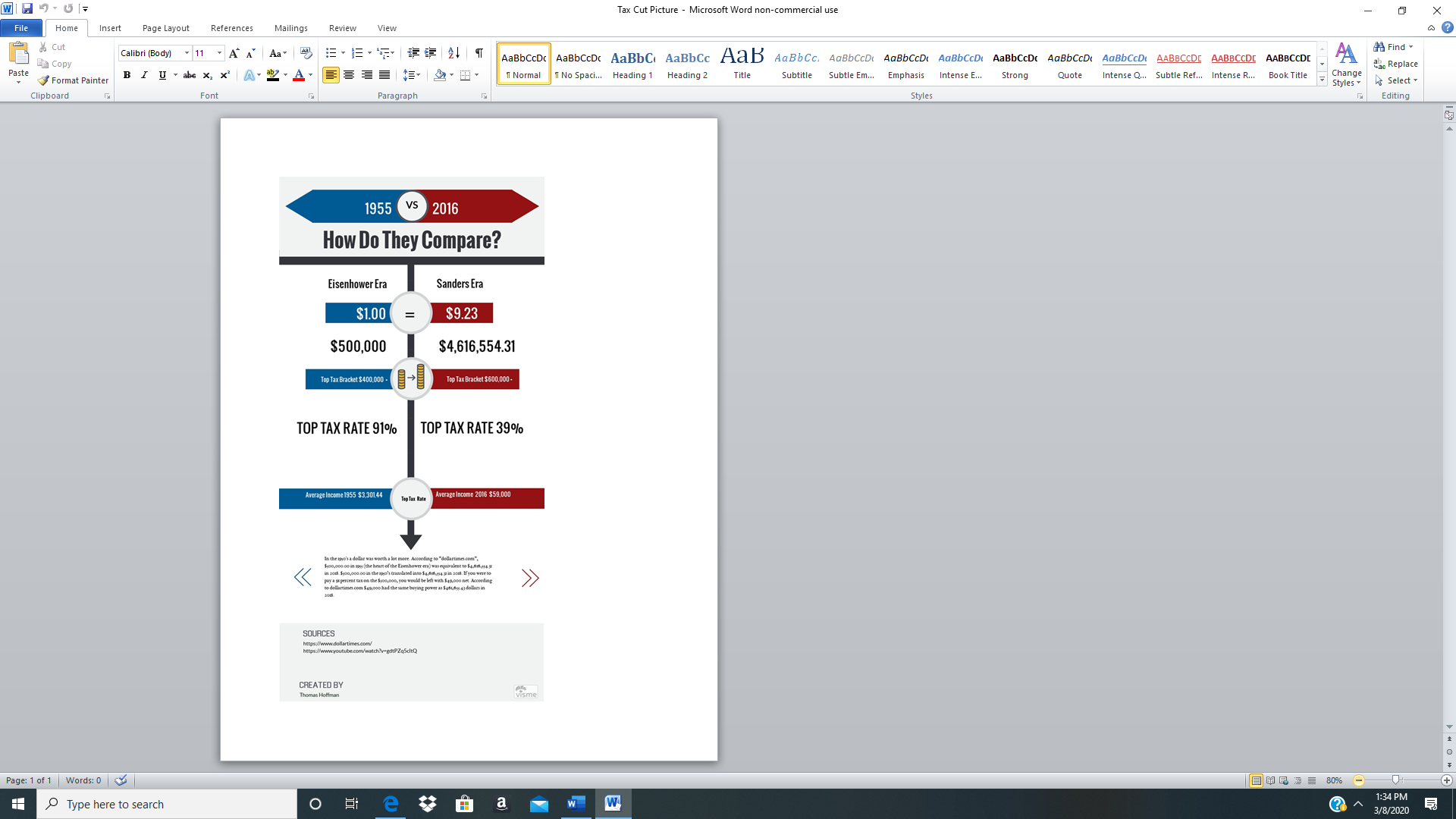

However, was Eisenhower really more of a socialist than Senator Sanders? Is that truly an accurate comparison? High tax advocates like Sanders fail to factor in inflation. According insidegov.com, the top rate on regular income was 91 percent, and the highest tax tier was $400,000+. In the 1950’s a dollar was worth a lot more. Remember the I Love Lucy episode where it is revealed Lucy and Ricky only pay several hundred dollars a month for that Murray Hill apartment? Several hundred dollars a month really could obtain a Manhattan apartment in the time of President Eisenhower.

According to dollartimes.com, $500,000.00 in 1955 (the heart of the Eisenhower era) was equivalent to $4,616,554.31 in 2018. $500,000.00 in the 1950s translated into $4,616,554.31 in 2018. If you were to pay 91 percent tax on the $500,000, you would have $49,000 net. According to dollartimes.com $49,000 had the same buying power as $461,655.43 in 2018. Even if inflation is factored into the current tax rates, some politicians do take this into consideration. Senator Sanders rarely includes the subject of inflation when debating this. It is truly unfair to compare the taxes of these two eras without including the subject of inflation. Eisenhower certainly possessed centrist views. It was Eisenhower who warned the nation of the hazard that is the military-industrial complex. Eisenhower probably would not approve of the financial policies of today’s conservatives. However it is not necessarily true he would approve of taxing to the extent that Sanders is calling for.