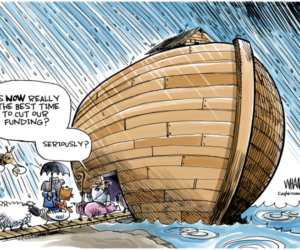

At many times and in many paces over the years, predatory taxes administered by cruel and grasping governments have caused enormous misery among huge segments of local populations. After the tax collectors came around impoverishment and not infrequently starvation followed. Hatred for the taxing authority invariably followed as well.

But hey, you rich people in today’s United States, that’s not the situation you face today. There isn’t a single thing proposed by President Obama or even the most progressive wing of his party that would lessen the wealth you already possess. And as to diminishing the amount of new income you would derive were Obama-Democratic Party tax proposals enacted, not one of these proposals would in any meaningful way lessen your personal comfort or alter your lifestyle.

So stop whining. Stop obstructing. Just pay the extra taxes that have to be assessed to meet real and necessary needs without employing the alternative — impoverishing a large number of your fellow Americans. And do this because you understand that to those whom much has been given much is expected — including a little more (and that’s what we’re talking about here) in the way of tax payments.

In passing…if any reader of these lines thinks I’m just writing as I do because I don’t myself happen to face higher rich person taxes, let me make this offer: Give me enough income so I net more than $200,000 a year, I will not only not whine if you raise my tax rate on income above this level, I will personally come by and clean your house and pool monthly.