When it comes to questions of how we’re going to pay for health care reform, clean air initiatives and everything else up to and including free ponies for everyone, many self-styled pundits have been crying out that we should tax the poncy, bourgeoisie bastards who hoard all the cash. “The rich should pay their fair share!” That’s the cry we hear.

When it comes to questions of how we’re going to pay for health care reform, clean air initiatives and everything else up to and including free ponies for everyone, many self-styled pundits have been crying out that we should tax the poncy, bourgeoisie bastards who hoard all the cash. “The rich should pay their fair share!” That’s the cry we hear.

You may want to read the following and then ask yourself exactly what their “fair share” really is.

Tax Burden of Top 1% Now Exceeds That of Bottom 95%

Newly released data from the IRS clearly debunks the conventional Beltway rhetoric that the “rich” are not paying their fair share of taxes.

Indeed, the IRS data shows that in 2007—the most recent data available—the top 1 percent of taxpayers paid 40.4 percent of the total income taxes collected by the federal government. This is the highest percentage in modern history. By contrast, the top 1 percent paid 24.8 percent of the income tax burden in 1987, the year following the 1986 tax reform act.

Remarkably, the share of the tax burden borne by the top 1 percent now exceeds the share paid by the bottom 95 percent of taxpayers combined. In 2007, the bottom 95 percent paid 39.4 percent of the income tax burden. This is down from the 58 percent of the total income tax burden they paid twenty years ago.

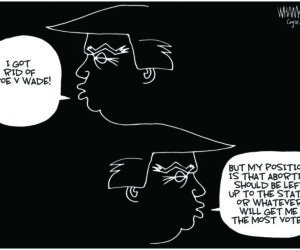

But that won’t slow down some folks. As long as there is anyone who is perceived as one of “the haves” by the rest of the “have nots,” the calls to have them foot the bill for everything will continue.

And this is the way that empires fall, sooner or later. You rarely go down to a hostile outside force. You tear yourself down from within.