Despite the recently signed bailout, world markets are now reeling — and the stock market has now fallen below 10,000:

Stocks tumbled Monday, with the Dow Jones industrial average falling below 10,000 for the first time in nearly four years, as European governments’ rush to prop up failing financial firms underscored the global reach of the credit crunch.

Credit markets remained tight, with two key measures of bank jitters hitting an all-time high. Treasury’s rallied, lowering the corresponding yields as investors sought safety in government debt. Gold rallied for the same reason. Oil dipped. The dollar was mixed versus other major currencies.

The Dow Jones industrial average (INDU) lost around 400 points or 4% in the early going, and fell below 10,000 for the first time since Oct. 29, 2004. The Standard & Poor’s 500 (SPX) index and the Nasdaq composite (COMP) both lost more than 5%.

Stocks slumped Friday, as the Wall Street’s worst week in seven years ended with President Bush signing the historic $700 billion bailout bill after weeks of contentious debate. The bill involves the Treasury buying bad debt directly from banks in order to get them to start lending to each other again.

In financial terms it means, despite the bailout, the U.S. will have to find ways to do more to not just prop up its own sagging economy, but reassure world markets.

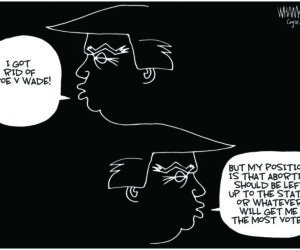

In political terms, the headlines mean the economic issue will remain the dominant one.

Joe Gandelman is a former fulltime journalist who freelanced in India, Spain, Bangladesh and Cypress writing for publications such as the Christian Science Monitor and Newsweek. He also did radio reports from Madrid for NPR’s All Things Considered. He has worked on two U.S. newspapers and quit the news biz in 1990 to go into entertainment. He also has written for The Week and several online publications, did a column for Cagle Cartoons Syndicate and has appeared on CNN.