Are U.S. Oil and Insurance Companies Dealing in Collusion?

by John T. Johnson, III

I’ve got a question for the politicians we have elected to protect our best interests. Are major U.S. oil companies and insurance companies involved in collusion?

The Merriam-Webster dictionary defines “collusion” as: a secret agreement or cooperation especially for an illegal or deceitful purpose.

I was prompted to ask this question because in 2008, I watched the price of fuel climb steadily upwards while I read in the newspapers, and heard all the talking heads on the cable channels tell us that there was a glut of crude oil in the world.

I was told that huge tankers were being used as floating oil storage facilities because U.S. refiners had cut back on refining.

The refiners, by their own admission, had cut back refining because their profit margins on fuel sales were not what they wanted them to be; thereby manipulating a fuel shortage. If the market was truly competitive, they could not have done this without possibly losing their customers to a competitor.

The refining competition was all but eradicated back in the 80’s when the federal government started mandating that old, inefficient, independently owned refineries upgrade to systems more friendly to our environment. Many of these companies shut down operations. Several sold their equipment to foreign companies rather than meet the fed’s demands. Other independents were bought by the major players. The last new refinery was built in 1987.

Here’s the propaganda on the subject as broadcast by GasBuddy.com, who is responsible, along with umpteen other industry mouthpieces, for spitting out misinformation and half truths:

In the early 80’s the U.S. had 15.66 million barrels per day of refining capacity with 254 plants operating. Today while the number of plants operating has dropped to just 137, the capacity of plants has risen to 17.59 million barrels per day. While smaller plants have closed, large plants have increased, expanded, and replaced old equipment with newer, more efficient equipment.

This is true, but as Paul Harvey would say, “And now, the rest of the story”.

During the last 20+ years U.S. demand for refined fuels has greatly increased, so the increase in production during this period has not kept pace with demand. We, in fact, have to import between two and three million barrels of finished fuels each day.

When operating at max capacity, all is well, but what happens when a hurricane hits the Gulf of Mexico and refineries start shutting down, or when there is an explosion or fire, or when just one large operation “shuts down for seasonal maintenance”? You know the answer …prices at the pump start to skyrocket.

This would not happen if there were more independents out there and if refining capacity and reserves were increased.

When a hurricane builds up steam and looks like it might hit the gulf, prices at the pump immediately inch upward. It makes no difference if it ever makes it to the Gulf or not. When the price of a barrel of oil takes a nosedive, it takes weeks to drop down a few cents.

In July, 2008, when the price of a barrel of crude was at $141, the average price of fuel nationwide was $4.114 per gallon. The price per barrel in May, 2009, was at $58 and the national average at the pump was $2.248 a gallon on May 12th.

From July 2008 until May 2009, crude dropped 59% to $58 per barrel. The price per gallon at the pump during this same period only dropped 54%. See anything wrong with this ratio? Why aren’t the drops in the two categories proportional? This is big money. Where did it go? Look at the profit margins of the world’s largest oil companies. The answer should be obvious.

The situation reminds me of something I learned back in the ‘80’s while on business in the Philippines. I had flown into Manila the day before and noticed that the public was in somewhat of an uproar. When I asked my ex-patriot friend about it, he told me that there was a shortage of rice and that the rice that was available was very expensive. This seemed odd since I knew that rice was grown throughout the country, and could not understand why there would be a shortage.

He went on to explain that there was not a shortage in the fields and warehouses; there was just a shortage on the store shelves. It was a manufactured shortage, concocted by all the Chinese merchants who control the sale and distribution of rice in the Philippines. He told me that in a few days rice would again be in all the stores, and that the price would be somewhat less than the high mark hit during the “shortage”. “However”, he said, “The price will never drop back down to pre-shortage levels.”

“It will probably happen again in a few months,” he added.

I want someone in the know … someone in D.C. …to tell me what the difference is in the manufactured rice shortages in the Philippines and what we are now experiencing with manipulated fuel pricing here in the U.S. They seem to have much in common.

Supply and demand is not controlling the price of fuel now like it is supposed to in a free market. Since one process in the chain is now being manipulated, prices at the pump are higher than they should be. The ratio between cost of crude to price at the pump grows wider.

Wikipedia posts this perspective: Economist James K. Galbraith believes that much of the rise is due to the “Enron loophole” drafted in a rider by former Texas senator Phil Gramm, which allowed energy futures to avoid Commodity Futures Trading Commission oversight. Galbraith cites Masters, a hedge fund manager, who observed that index speculation tied to commodities by pension funds and other investment vehicles rose from $13 billion in 2003 to $250 billion in 2008. Galbraith observed that with Goldman Sachs predicting a rise in the price to $200 and Gazprom $250, suppliers may react to the rise by restricting supply until they can sell their product at a higher price.

A recent piece by Kevin G. Hall with McClatchy Newspapers states, “… during a recent week almost 9 in 10 traders who bet that oil prices would rise were financial speculators, not end users of oil.

“The futures markets are important. They allow airlines to buy jet fuel and cereal makers to buy grain to hedge against the risk of changing prices by purchasing contracts for future delivery at a set price. A buyer and seller negotiate a fair market value, but a growing number of experts now say excessive speculation in those markets has driven up prices to the speculators’ profit and to the punishment of the public.”

The price of wheat is soaring for the same reason…Wall Street banks and hedge funds investing for the ultrawealthy – not interests seeking to ever use the wheat.

We can only hope that regulatory rules are reinstated that will place position limits on how much speculators can invest in what is now nothing more than legalized gambling in a game that is rigged.

Are you going to continue to believe the propaganda the oil companies and Wall Street spits out? Not me. It appears they picked up some tricks from the Chinese rice wholesalers in the Philippines.

If you want another example of how closely the Big Oil guys work with each other, you might remember the brouhaha surrounding the discovery of British Petroleum’s Gulf Disaster Contingency Plan which was all bound up nice and neat and made references to a spill’s affect on walruses and other arctic fish and mammals not seen in the Gulf of Mexico for millions of years.

As crazy as this was, I found another discovery much more interesting…the fact that other major oil company’s Gulf contingency plans mirrored B.P.’s, the only difference being the cover page which had their company’s respective names affixed. You don’t think they are all in cahoots?

Here’s what CNN Money had to say about the issue back in August of 2010:

At a Congressional hearing In June, lawmakers slammed executives from five of the world’s largest oil companies for having cookie-cutter contingency plans for dealing with disasters like oil spills.

Those plans included embarrassing errors such as a reference to protecting walruses, which haven’t lived in the Gulf Coast for at least 3 million years, and the phone number of a marine biologist who died five years ago.

This is why our government has to consider controlling the consumables that we cannot live without … refined fuels, natural gas, electricity, and water. The big players gobble up the small, become cozy, divide up territories, and real competition morphs into pseudo competition. This is not free enterprise; it is capitalism gone bad.

The same level of greed and collusion can be found in our health insurance companies. Look what they have done. Just like with oil companies, the big have gobbled up the small, and then one Big buys, or merges with, one of the other Big’s until we are reduced to having only a handful of gigantic players and a few insignificant others.

Our government has allowed this to happen. In the past 20+ years, anti-trust laws have all but been forgotten. It seems that no buyout is too big to be rejected by those charged with protecting us little guys.

Proof of this collusion in heath insurance ought to be obvious to all since all insurance companies are “not allowed” to offer policies nationwide. States have to approve each company; each company can pick and chose where it wants to apply for a license to sell.

I think that the insurance companies themselves have “manufactured” these barriers through helpful state legislators so that they could divide up the country and have their own little fiefdoms. Why else would a state not open its borders to each and every qualified company to promote the healthiest competition possible?

And let’s not leave out the pharmaceutical companies. They seem to have learned some tricks from Big Oil. Here’s a recent report on drug shortages and skyrocketing prices as reported in the San Antonio Express News:

Like many hospital pharmacists, Mark A. Richerson has been struggling with an ever-expanding list of prescription drugs that are either in short supply or unavailable. The situation, he says, “is the worst I’ve seen in my 25 years as a pharmacist…” Normally, Christus Santa Rosa Health Care, where Richerson is the director of pharmacy, pays an average of $15.76 for a 2-gram vial of cytarabine. With the drug in short supply, Richerson earlier this month received a fax from Miami-based Allied Medical Supply offering 17 vials for $995 each — an astonishing markup of 6,213 percent.

Part of the problem, the drug manufacturers say, is attributed to more stringent rules and oversight by our federal government, which has prompted them to review their manufacturing processes and drop some drugs from production altogether. Many of the older drugs are even being discontinued because “they are not cost effective for companies to make”. Translation – they cut back production to drive up the cost, just like the rice wholesalers.

Buyouts and consolidations have also compounded the problems. All you have to do is merge with the competition and drive up the cost.

Recent events have shown us that we cannot expect private enterprise to consider the public’s best interests when weighed against their inherent greed. It is a disease that has no cure. It can only be managed by diligent oversight. It is called “regulation”.

I was always against regulation, but not anymore. With our elected officials being bought off, with anti-trust laws being redefined, with formed cabals being overlooked, I’ve changed my mind. Watch them, monitor them, and give them some guidelines to follow. They are out of control.

If we would study our history, we would be much better prepared to determine just how well deregulation works when it comes to banking and key products and services. Greed is a virulent disease, and without proper treatment in the form of laws and regulations, it will run rampant. A century ago, you would have found the same symptoms you see today…the divide between the rich and poor growing broader.

As a “Progressive Republican”, one of Teddy Roosevelt’s heralded accomplishments was his success in trust busting and increased regulation of large corporations. The railroad, banking, steel, oil and tobacco industries were becoming the “Have’s”; everyone else, the “Have Not’s”. Roosevelt regulated them. He called this program the “Square Deal”, stressing that the average citizen would get a fair share under his policies.

Several years later, his cousin, Franklin D. Roosevelt, fought to control the electric utilities and the utility holding companies that were manipulating costs.

History is repeating itself. Big Oil, Big Insurance, Big Banks are out of control ….literally. Those we have elected to protect us from this greed and corruption need to start doing so. They have been serving the wrong master for too many years now. The Big’s have bought up the competition, and anti-trust rules and regs have watered down. We need to resurrect Teddy R. so he could shove sharp bits in their mouths.

If you agree, speak up.

John T. Johnson, III. is a Texas entrepreneur who has been involved with everything from the travel business, to specialty tool design for nuclear power plants, to food brokerage, to heavy construction equipment sales to S.E. Asia, to pond raised shrimp in Central America, to the design and patenting of new products for the military and oil production industries. He has been married to his wife, Donna, for 37 years, has two grown children, and resides in Arlington. John T. Johnson, III, can be contacted @ [email protected]

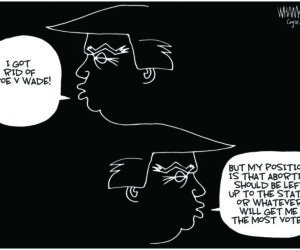

The copyrighted cartoon by Bill Day, Cagle Cartoons, is licensed to run on TMV. Unauthorized reproduction prohibited.