There had been some doubt among many whether — despite their assures they would not — Team Obama was going to make the same mistake it made after the 2008 elections and not use its impressive campaign apparatus linked up via email with millions of supporters to clamor and fight for Obama’s positions.

Now there is no doubt they won’t make the same mistake: Stephanie Cutter, Deputy Campaign Manager of Obama for America, has just sent out this email, which we’ll run in full:

Friend —

Who will decide if your taxes increase in just 22 days? A few dozen members of the House of Representatives, that’s who.

Cutting taxes for the middle class shouldn’t be difficult, especially when Republicans claim they agree with the President on the issue. But some Republicans are still holding middle-class tax cuts hostage simply because they want to cut taxes for millionaires and billionaires.

Here’s what’s going on right now: President Obama is asking Congress to move forward on a plan that would prevent 98 percent of American families from paying higher taxes next year. The Senate has passed that bill, and the President is ready to sign it — but the Republican leadership in the House of Representatives won’t even bring the bill to the floor for a vote. House Democrats have filed a petition that would force a vote if it attracts 218 signatures.

If a bill has enough votes to pass, Congress should vote on it and pass it. It’s a pretty simple proposition. And every Member of Congress who hasn’t signed on to keep taxes low for the middle class needs to hear from you.

Your representative in Congress, Susan A. Davis, has already done their part to help bring the bill to the floor. But there are dozens more who still need to step up and do the right thing.

Use the call tool today to reach out to fellow Obama supporters and make sure they contact their Republican representative.

Let’s get one thing straight: If your taxes go up, Republicans will have made a conscious choice to let that happen. They’ll have missed the opportunity to prevent it, just to cut taxes for the wealthy.

Republicans need to stop using the middle class as a bargaining chip. If they fail to act, a typical middle-class family of four will see a $2,200 tax hike starting in a few short weeks. Middle-class families could face some tough financial decisions simply because Republicans didn’t want to ask the wealthiest 2 percent of Americans to pay their fair share.

That’s not what President Obama and you campaigned on, and that’s not what millions of Americans voted for just one month ago.

We know we can affect change in Washington when we raise our voices together. So pick up the phone and make a few calls. Republicans in the House need to hear from their constituents. You can help:

http://my.barackobama.com/Call-Tool

Thanks,

Stephanie

Stephanie Cutter

Deputy Campaign Manager

Obama for America

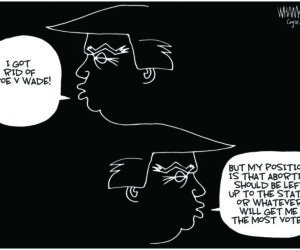

Joe Gandelman is a former fulltime journalist who freelanced in India, Spain, Bangladesh and Cypress writing for publications such as the Christian Science Monitor and Newsweek. He also did radio reports from Madrid for NPR’s All Things Considered. He has worked on two U.S. newspapers and quit the news biz in 1990 to go into entertainment. He also has written for The Week and several online publications, did a column for Cagle Cartoons Syndicate and has appeared on CNN.